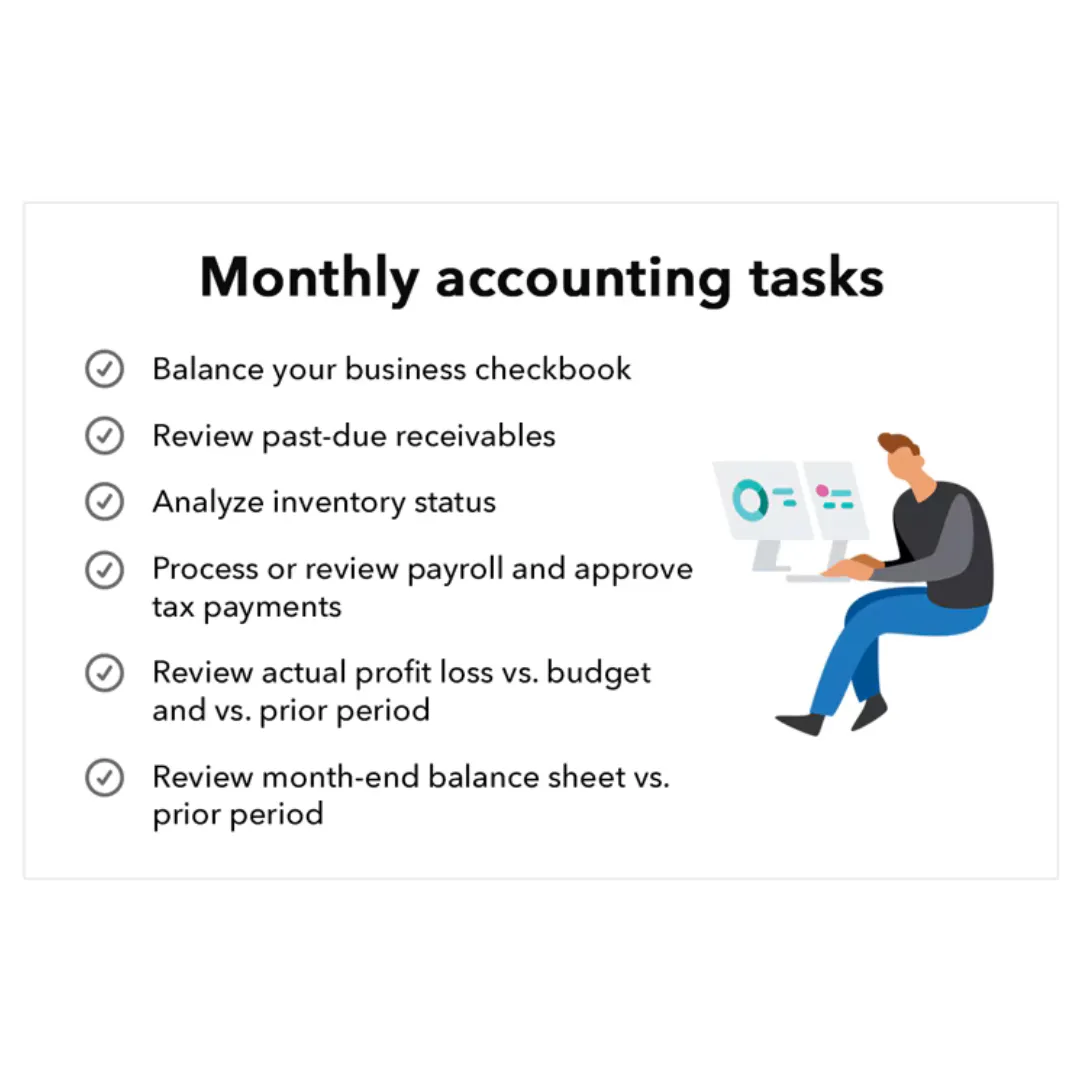

Accounting Services For Businesses.

Job Costing

Implementing job costing techniques helps painters track and allocate expenses related to specific projects. MP Bookkeeping can assist in setting up systems to monitor materials, labor, and overhead costs, providing a clear picture of project profitability.

Expense Tracking

Business owners rely heavily on supplies and equipment to keep their business running. MP Bookkeeping can help streamline expense tracking, ensuring accurate records of supplies purchased for each project. This aids in budgeting and facilitates tax deductions.

Mileage Tracking

For businesses on the move, tracking mileage is crucial. MP Accounting can implement systems to record and categorize business-related travel, helping painters maximize deductions and comply with tax regulations.

Cash Flow Management

Managing cash flow is vital for businesses dealing with fluctuating project timelines and payment schedules. MP Bookkeeping can assist in developing strategies to maintain healthy cash flow, ensuring operational stability and financial flexibility.

Estimation and Invoicing

Creating accurate estimates and timely invoicing are crucial for business owners. MP Bookkeeping can help implement systems to streamline the estimation process and ensure that invoices are generated promptly, facilitating quicker payments.

Tax Planning for Seasonal Fluctuations

Business owners often experience seasonal fluctuations in business. MP Bookkeeping can provide tax planning strategies to help manage income variations, ensuring optimal financial outcomes during both peak and off-peak seasons.

Equipment Depreciation

Businesses frequently invest in expensive equipment. MP Bookkeeping can help with proper depreciation tracking, maximizing tax deductions over time and ensuring accurate financial reporting.

Compliance with Industry Regulations

MP Bookkeeping can stay informed about industry-specific regulations affecting your industry, ensuring compliance with licensing, insurance, and other requirements that may impact the financial health of the business.

FAQS

What accounting services do you offer?

We offer a comprehensive range of accounting services tailored to meet the unique needs of businesses. Our services include bookkeeping, financial reporting, payroll management, budgeting and forecasting, audit preparation, and more. Whether you're a small startup or a large corporation, our team of experts can provide the financial support you need to thrive.

How do your fees work, and are they affordable?

Our fee structure is designed to be transparent and competitive. We understand that cost is a concern for many businesses. The exact fees can vary depending on the scope and complexity of the services you require. We offer customized pricing packages to ensure you only pay for the services you need. Our goal is to provide high-quality financial services that are not only effective but also affordable. We're happy to discuss your specific requirements and provide a clear, upfront estimate.

How can I be sure my financial data is secure with your company?

We take data security seriously. Your financial data is treated with the utmost care and protected using industry-standard security measures. Our systems are regularly updated and audited to ensure they meet the highest security standards. Additionally, our team undergoes rigorous training to maintain the confidentiality and integrity of your data. You can trust that your financial information is safe when you partner with us. If you have specific security concerns or questions, please don't hesitate to reach out, and we'll be happy to address them.